NEW YORK—A federal judge on March 28 sentenced FTX founder Sam Bankman-Fried to 25 years in prison for defrauding investors of $8 billion in the fallen cryptocurrency exchange.

U.S. District Judge Lewis Kaplan handed down the sentence at a Manhattan court hearing after rejecting Mr. Bankman-Fried’s claim that FTX customers did not actually lose money and accusing him of lying during his trial testimony. In November, jurors convicted Mr. Bankman-Fried of all seven counts of conspiracy and fraud with which government lawyers charged him.

“He knew it was wrong,” Judge Kaplan said of Mr. Bankman-Fried before handing down the sentence. “He knew it was criminal. He regrets that he made a very bad bet about the likelihood of getting caught. But he is not going to admit a thing, as is his right.”

The judge also ordered forfeiture of $11.2 billion but did not order restitution, saying it would be “impractical” because there were so many victims.

The judge particularly took issue with Mr. Bankman-Fried’s lack of remorse.

Earlier in the hearing, the FTX founder, wearing a beige short-sleeve jail t-shirt, apologized to investors.

“A lot of people feel really let down, and they were very let down, and I am sorry about that,” he said. “I am sorry about what happened at every stage.”

Judge Kaplan said he had found that FTX customers lost $8 billion, FTX’s equity investors lost $1.7 billion, and that lenders to the Alameda Research hedge fund Bankman-Fried founded lost $1.3 billion.

“The defendant’s assertion that FTX customers and creditors will be paid in full is misleading, it is logically flawed, it is speculative,” Judge Kaplan said. “A thief who takes his loot to Las Vegas and successfully bets the stolen money is not entitled to a discount on the sentence by using his Las Vegas winnings to pay back what he stole.”

Mr. Bankman-Fried and his attorneys had repeatedly argued that he didn’t intentionally do anything wrong and that he deserves no more than 6 1/2 years in jail. In his trial testimony in October, Mr. Bankman-Fried insisted he used sophisticated analytics to try to keep track of the state of FTX’s finances and suggested that subordinates acting without his knowledge or imprimatur made costly mistakes.

But prosecutors, citing testimony from Alameda Research head Caroline Ellison, who was at times romantically involved with Mr. Bankman-Fried, vehemently disagreed with the more charitable view and are pressing for a sentence of half a century or longer.

At the sentencing hearing, Mr. Bankman-Fried’s attorney Marc Mukasey sought to portray the FTX founder as a well-meaning “awkward math nerd.”

“Sam’s an incredibly kind-hearted and generous person,” Mr. Mukasey told the court, adding that Mr. Bankman-Fried thought he could make his investors whole if he had more time.

Prosecutor Nicolas Roos countered, telling the court, “The criminality here is massive in scale. It was pervasive in all aspects of the business.”

“Sam Bankman-Fried stole over $8 billion in customer money, and I emphasize stole because it was not a liquidity crisis, or an active mismanagement, or poor oversight from the top,” Mr. Roos said.

Mr. Bankman-Fried has vowed to appeal his conviction and sentencing.

Dominoes Fall

The conviction in November came exactly one year after a Nov. 2, 2022, report in the cryptocurrency publication Coindesk began to stoke wide concern about the state of FTX’s finances. The report cited a leaked balance sheet of FTX’s hedge fund trading affiliate, Alameda Research.

According to Coindesk’s analysis, a bulk of Alameda’s $14.6 billion of assets was in the form of FTX’s own crypto token, FTT, rather than a fiat currency. This not only suggested that Alameda’s wealth was potentially less fungible than many had assumed but also pointed to extensive commingling of FTX customer deposits with the hedge fund affiliate.

Whether or not Coindesk was correct to impute instability and weakness to FTX on the basis of its position in FTT, the reaction in the market was swift. On Nov. 6, 2022, Changpeng Zhao, then-CEO of Binance, one of the other leading cryptocurrency exchanges, sent out a sharply worded post on Twitter.

Mr. Zhao alluded to the fact that Binance had been distancing itself from FTX over the past year and had received the equivalent of about $2.1 billion in U.S. dollars in the form of both cash and the FTT token.

“Due to recent revelations that have come to light, we have decided to liquidate any remaining FTT on our books. We will try to do so in a way that minimizes market impact,” Mr. Zhao wrote.

Despite that assurance, Binance’s move, and forthright public announcement, immediately helped fuel a run on the bank during which customers pulled $6 billion from FTX in three days.

The exchange would never recover; some $9 billion of customer funds are still lost through the commingling of funds and Mr. Bankman-Fried’s lavish spending.

The Feds Move In

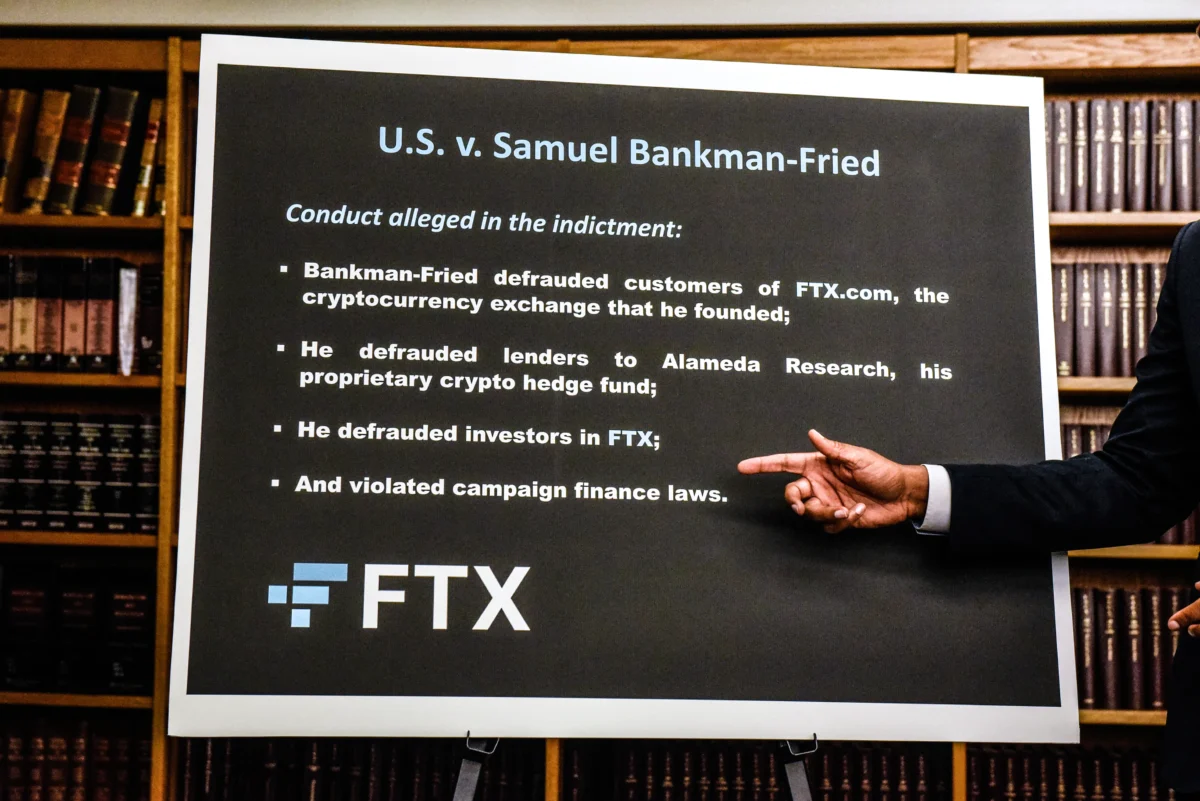

U.S. federal prosecutors were quick to take action. On Dec. 13, 2022, the Department of Justice announced that a federal grand jury had returned an indictment charging Mr. Bankman-Fried with wire fraud, conspiracy to commit wire fraud, securities fraud, money laundering, campaign finance violations, and fraud against the Federal Election Commission.

The last allegation relates to Mr. Bankman-Fried drawing upon customer deposits to make large donations to both Democrats and Republicans with whom he wanted to curry favor.

But it was mainly Democrats who benefited from Mr. Bankman-Fried’s largesse, including a reported $5.2 million donation to then-candidate Joe Biden in 2020. According to The Wall Street Journal, this gift made Mr. Bankman-Fried second only to Michael Bloomberg among top-spending backers of President Biden.

Government lawyers briefly dropped the campaign finance charges on the technical grounds that Bahamas authorities hadn’t included them among their stated grounds for extraditing Mr. Bankman-Fried from the Bahamas to New York to face trial in December 2022. Then, in August 2023, prosecutors did an about-face and announced that Mr. Bankman-Fried was still on the hook for campaign finance violations.

“The Justice Department has filed charges alleging that Samuel Bankman-Fried perpetrated a range of offenses in a global scheme to deceive and defraud customers and lenders of FTX and Alameda, the defendant’s crypto hedge fund, as well as a conspiracy to defraud the United States government,” Attorney General Merrick Garland said.

Michael J. Driscoll, assistant director of the FBI’s New York office, was blunt about Mr. Bankman-Fried’s misuse of FTX deposits to pay Alameda’s expenses and to make other investments.

“If you deceive and defraud your customers, the FBI will be persistent in our efforts to bring you to justice,” Mr. Driscoll said.

Reuters contributed to this report.

From The Epoch Times