As the Biden administration’s plan to erase more than $400 billion in federal student loan debt failed at the U.S. Supreme Court, both Democrats and Republicans are saying they have an answer to help with the looming student loan default crisis.

To fulfill his campaign promise, President Joe Biden has pledged that he’ll still push through a blanket student debt cancellation but using a different legal authority to do so.

Republican lawmakers are championing what they say is a “fiscally responsible, targeted alternative” to Mr. Biden’s plan that focuses on making it easier for borrowers to transit back into repayment.

Biden’s Plan B

Mr. Biden’s plan, which would “forgive” up to $10,000 in student loan debt for those earning less than $125,000 and another $10,000 for Pell Grant recipients who meet the income limit, was originally relying on what’s known as the HEROES Act, a law passed in the aftermath of the Sept. 11 terrorist attacks.

Congress passed the first version of the HEROES Act in 2001, allowing the education secretary to waive or modify federal student loan rules for those affected by the attack. The law was expanded in 2003 to cover borrowers affected by “a war, military operation, or national emergency,” as the secretary deems necessary.

The law defines an “affected” individual as someone who’s serving in active military duty, who lives in a disaster area, or who suffered “direct economic hardship” as a direct result of a national emergency. The Biden administration argued that this would allow the secretary to cancel student loans in response to the COVID-19 public health emergency.

However, the high court wasn’t convinced that the HEROES Act would give the Biden administration authority to implement such a far-reaching plan.

“The HEROES Act … does not allow the Secretary to rewrite that statute to the extent of canceling $430 billion of student loan principal,” Chief Justice John Roberts wrote for the 6–3 majority, noting that the “modifications” outlined in Biden’s plan “created a novel and fundamentally different loan forgiveness program” that “expanded forgiveness to nearly every borrower in the country.”

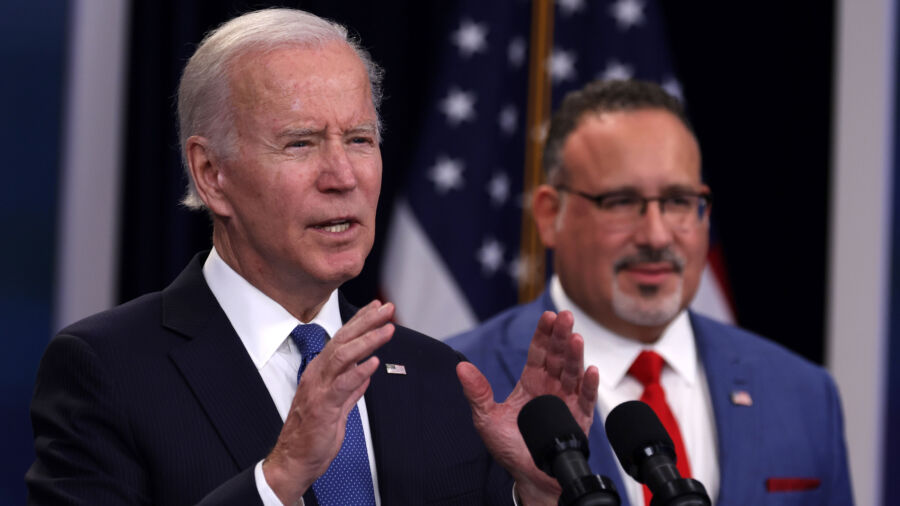

Hours after the Supreme Court ruling, Mr. Biden commented from the White House that he would find a new legal basis for the debt cancellation.

A second attempt will be relying on the Higher Education Act (HEA) of 1965, which he said includes a mechanism to allow the education secretary to “compromise, waive, or release loans under certain circumstances.”

“Today’s decision has closed one path,” the president said. “Now we’re going to pursue another. … We’ll use every tool at our disposal to get you the student debt relief you need.”

The HEA has been proven to be a constitutionally sound tool for debt relief. In April, the Supreme Court declined to take on a request to block Education Secretary Miguel Cardona from using his HEA authority to wipe out $6 billion in student loan debt owed by borrowers who claimed they didn’t receive the kind of education their schools had promised.

However, it takes a different process to cancel student loan debt using the HEA, since this older law doesn’t involve any emergency authority that might allow the government to bypass the typical lengthy, tedious rule-making procedure. Before any changes can come into effect under the HEA, it usually has to first undergo many rounds of public hearings and months-long comment periods that require an extensive amount of public input.

On July 5, the Education Department announced the formal beginning of the “negotiated rule-making” process for the establishment of a new student loan cancellation plan.

“We announce our intention to establish a negotiated rule-making committee to prepare proposed regulations for the Federal Student Aid programs authorized under title IV of the Higher Education Act of 1965,” Mr. Cardona said in a statement. “We intend to convene a committee to develop proposed regulations pertaining to topics … which relate to the modification, waiver, or compromise of Federal student loans.

“The committee will include representatives of organizations or groups with interests that are significantly affected by the subject matter of the proposed regulations.”

The department will start accepting public comments and will convene its first formal negotiated rulemaking meeting on July 18.

Republican Alternatives

Prior to last month’s Supreme Court ruling that struck down Mr. Biden’s plan, a group of House Republicans introduced their own plan, which they say will ensure “a smooth transition back into repayment” while still providing relief to those most in need.

The proposal, formally called Federal Assistance to Initiate Repayment (FAIR) Act, is sponsored by Rep. Virginia Foxx (R-N.C.), who chairs the House Education Committee, along with Reps. Burgess Owens (R-Utah) and Lisa McClain (R-Mich.).

Among other things, the bill focuses on adjusting income-driven repayment (IDR) plans, in which the monthly payment amount is primarily based on the student loan borrower’s income, and any remaining balance will be discharged at the end of the 20- or 25-year repayment term.

Specifically, this Republican proposal would condense the four existing IDR plans into one “predictable and affordable” plan, require borrowers enrolled in the new IDR plan to recertify their income before payments resume, and make sure that repayment assistance phases out as borrower’s incomes increase and they’re able to repay their loans.

When it comes to debt relief, the bill would eliminate time-based discharge of the remaining loan balances and instead, waive borrowers’ remaining balances if they “already paid back more than they originally owed taxpayers in principal and interest.” It would also give defaulted borrowers a second chance to reenroll in a repayment plan, removing the black mark of default from their credit report as long as they make their required monthly payments.

More importantly, the bill would prevent the Biden administration from moving forward with its proposed IDR changes, which some critics say is so generous that it would turn the loan program into a quasi-grant program. Those changes, according to a September 2022 analysis by economist Adam Looney at the University of Utah, would, in effect, allow borrowers to only pay back less than 50 cents for every dollar they borrow.

“The FAIR Act is a fiscally responsible, targeted response to the chaos caused by Biden’s student loan scam,” the bill’s sponsors said in a joint statement. “This Republican solution takes important steps to fix the broken student loan system, provide borrowers with clear guidance on repayment, and protect taxpayers from the economic fallout caused by the administration’s radical free college agenda.”

In the Senate, Republicans have proposed the Lowering Education Costs and Debt Act, a five-bill package aimed at providing students and families with better information in the hope that they understand and carefully compare their options before borrowing what they might not be able to pay back.

This collection of bills, according to primary sponsor Sen. Bill Cassidy (R-La.), would streamline repayment options, require some loan counseling, improve transparency about college programs, standardize student aid offers, limit graduate school borrowing, and prevent new loans from going into undergraduate and graduate programs where former students can’t earn more than a high school graduate or a bachelor’s degree, respectively.

“If students are going to make wise choices about the cost of education, and what sort of help they get to go to college, they ought to be comparing apples with apples, not apples with oranges,” said another sponsor, Sen. Chuck Grassley (R-Iowa).

As of the first quarter of 2023, nearly 44 million borrowers collectively owed more than $1.6 trillion in federal student loans. That portfolio makes the U.S. Department of Education the country’s biggest consumer lender, surpassing financial giants such as Bank of America, JPMorgan Chase, and Capital One.

From The Epoch Times