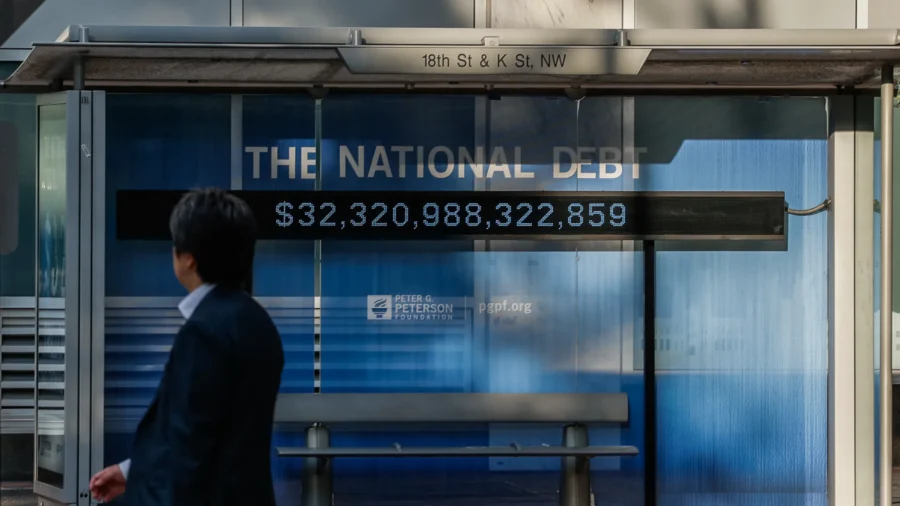

The national debt eclipsed $33 trillion on Sept. 15, while the budget deficit is on track to reach $2 trillion in the current fiscal year. Experts say that the public is becoming numb to these figures because they have become the new normal in Washington.

But while soaring debt and deficits are the status quo in the nation’s capital, economists are combing through the books to assess the U.S. government’s fiscal picture.

Federal spending is poised to top $6.5 trillion in the current fiscal year. This is down from the pandemic high of close to $8.9 trillion, but it is up 33 percent from the pre-crisis level of $4.875 trillion.

President Joe Biden has repeatedly claimed that he slashed the budget deficit by $1.7 trillion. But this has been considered a misleading assertion by many observers since most of the decline in federal outlays resulted from the expiration COVID-related stimulus and relief spending rather than employing any fierce budget cuts by the White House or Congress.

Over the last year, federal spending has totaled more than 24 percent of gross domestic product, fueled by Social Security, Medicare, and interest payments. At the same time, the challenge for the current administration and lawmakers is that revenues are down approximately 10 percent, according to the Congressional Budget Office (CBO).

This mismatch has produced a rolling 12-month deficit of approximately $2 trillion. If it were not for the Supreme Court’s decision to block President Biden’s student loan forgiveness program, the budget gap could have widened another $330 billion in August.

Meanwhile, it does not appear deficits will be slowing down any time soon. The CBO forecast that deficits will “fluctuate between $1.6 trillion and $1.8 trillion and then grow to $2.9 trillion in 2033.”

With the new fiscal year soon approaching, Congress has failed to approve appropriations legislation or stopgap spending laws to prevent a government shutdown. Current funding for most federal programs, except for Social Security payments and the military, expires on Sept. 30. If lawmakers do not approve a new budget, many components of the government will temporarily close, but the nearly 20 House Republicans making fiscal-related demands believe it is a fight worth having.

While a government shutdown might not be as threatening to the national economy as failing to raise the debt ceiling, analysts estimate that it could trim the GDP by 0.2 percent for every week Washington remains shuttered.

Interest Payments Soar

Interest payments are on track to exceed $1 trillion before the current fiscal year is over. It is estimated that daily interest spending has increased to around $2 billion over the last 12 months.

This has become one of the largest budgetary items (pdf), sitting behind only Social Security, which has already topped $1.2 trillion in the first 11 months of 2023.

One of the main reasons why annual budget holes have gained more attention is the significant jump in interest payments in a climate of rising interest rates amid the Federal Reserve’s fight to rein in inflation.

Since March 2021, the policy rate has climbed by 500 basis points to a target range of 5.25 percent and 5.5 percent. Additionally, Treasury yields have soared, with the benchmark 10-year yield hitting its highest level since 2007.

However, Treasury Secretary Janet Yellen is not too concerned about the nation’s intensifying debt burdens, alluding to one statistic that measures net interest payments relative to the GDP.

“The statistic or metric that I look at most often to judge our fiscal course is net interest as a share of GDP,” Ms. Yellen told CNBC on Sept. 18. “And even with the rise we have seen in interest rates that remains at a very reasonable level.”

Last year, the ratio was 1.86 percent, mirroring the historical average since 1960. However, the White House Office of Management and Budget (OMB) projects that this figure will climb to 2.5 percent this year and then rise to 2.9 percent in 2024 and 2025.

The CBO warned this past summer that this metric could increase to nearly 7 percent of GDP by 2053.

“Such high and rising debt would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook; it could also cause lawmakers to feel more constrained in their policy choices,” the budget watchdog wrote in a report.

Even with President Biden and House Speaker Kevin McCarthy’s (R-Calif.) Fiscal Responsibility Act, the debt ceiling plan will only skim about $188 billion in interest in the public debt over the next decade. In addition, by 2033, the federal government expects to have accumulated more than $17 trillion in deficits and paid about $3 trillion in interest payments, according to the White House’s 2024 budget proposal (pdf).

Feeling Numb

“We are becoming numb to these huge numbers, but it doesn’t make them any less dangerous,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget (CFRB), in a statement, adding that policymakers need to be honest with the American people and present a plan to “bring our debt under control.”

Are financial markets beginning to get worried?

Last month, Fitch Ratings downgraded U.S. government debt from AAA to AA+, with analysts sounding the alarm over “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance.”

From The Epoch Times