Businesses in Germany are becoming less confident about their economic future, according to a survey conducted by the Association of German Chambers of Industry and Commerce (DIHK).

Among the over 24,000 companies that took part in the survey, 52 percent are expecting their business to deteriorate over the next 12 months, with only 8 percent expecting an improvement, a DIHK Nov. 2 post said.

“This is the worst figure we have ever measured since the survey began in 1985,” DIHK Managing Director Martin Wansleben said in the post. “Even in the times of Corona and the financial market crisis, the share of optimists was more than 10 percent.”

The survey found that 82 percent of businesses see energy and commodity prices as a business risk. The survey has never measured such a high risk value, Wansleben said.

German industry has been particularly affected by the rise in energy prices, he pointed out. As a result, energy-intensive manufacturers of intermediate goods are “cutting back on their production,” he added.

More than one in five businesses in the rubber and plastics industry as well as over one in four companies in the chemical sector have been forced to cut back on production.

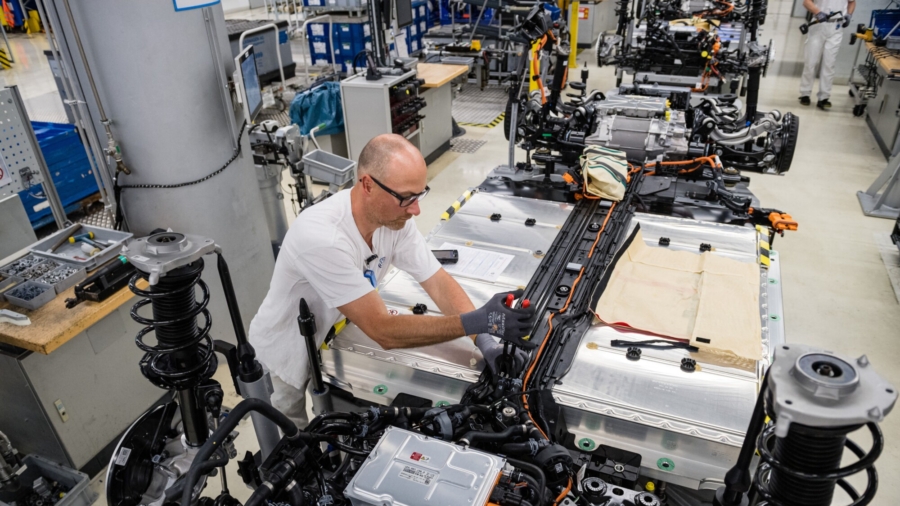

While 16 percent of firms in the automotive industry are also reducing production, 17 percent of automotive firms are planning to shift operations to other nations due to Germany’s high energy prices.

“Now, it is important that politicians also set the structural course for dynamic economic development, for Germany as a location still has a massive competition problem beyond the acute crisis. We will only be successful in the world in the future if we act, first and foremost as betterers, and not as know-it-alls,” Wansleben said.

Shifting Production, Economy

A study by Deutsche Bank estimates production in Germany to shrink by 2.5 percent in 2022 and then by 5 percent in 2023 due to rising energy costs. The study called the current time period as potentially the “starting point for accelerated deindustrialization” in Germany.

Though large German companies can shift their operations elsewhere, things are expected to be tougher for medium and small-sized businesses, which are the backbone of the country’s industry.

“For German SMEs … adapting to a new energy world will be a major challenge that some companies will fail at,” the study said.

The S&P Global/BME Germany Manufacturing Purchasing Managers’ Index (PMI) fell to 45.1 in October from 47.8 the previous month, which is the lowest reading since the initial COVID-19 wave in early 2020.

The PMI survey found that the German manufacturing sector’s downturn was gathering pace at the beginning of the fourth quarter. Faster declines in both output and new orders were registered.

From The Epoch Times