The Internal Revenue Service (IRS) has not diligently implemented the No TikTok Act for devices with access to government systems months after the law ought to have been enforced, leaving 2,800 IRS devices still capable of accessing the controversial Chinese app.

The Treasury Inspector General for Tax Administration (TIGTA) issued a report on its findings, documenting in detail how the IRS in some cases implemented and, in other cases, did not implement the No TikTok Act, which banned the use of TikTok on federal government devices of every kind.

TikTok is a social media application owned by ByteDance, a Chinese company with headquarters in Beijing, and has been accused of effectively working as a malware to spy on behalf of the Chinese communist regime. Every company in China, whether private or public, must have a communist party committee embedded in its structure, and this committee plays a significant role in decision making—effectively granting information from and control of every company to the Chinese Communist Party (CCP).

TIGTA’s inspection found that the IRS initially took some steps to block TikTok from the devices it gave to IRS employees. The IRS blocked access to TikTok’s website and made the application inaccessible on 6,300 mobile devices in October 2022.

However, some devices were exceptions.

The IRS allows employees to bring their own devices for use at the agency, in a program called Bring Your Own Device (BYOD). The new law requires such devices to be unable to access or download TikTok, according to TIGTA. However, the IRS did not block TikTok on these devices, as it did not notify its employees that the new law applied to their personal devices as well.

The IRS said it cannot enforce the new law on personally-owned devices without violating Constitutional rights. In talks with TIGTA, IRS management insisted that BYOD devices were not covered by the No TikTok Act, even though the Office for Management and Budget, which issued the guidance for the Act’s implementation, has clearly stated that BYOD devices at the IRS were included.

Even if the IRS informed its employees about the change, it would not be easy to ban TikTok on personally-owned devices, as the IRS cannot control which websites are accessed and which applications are downloaded on such devices. However, these devices are used for IRS work and can have access to, transmit, or store IRS information.

The second violation was that the IRS’s Criminal Investigation (CI) employees, who have a unique law enforcement mission, were another illegal exception to the new law, as TIGTA found that computers and mobile devices assigned to them still had access to TikTok. In total, 2,800 mobile devices belonging to the CI division could access TikTok, and 900 CI employees could access the website through IRS computers.

Even more concerning was that the IRS did not block access to TikTok on the 2,800 mobile devices after the inspection, with TIGTA not providing a reason for this inaction. The report says that the IRS issued a memorandum to its CI employees in May—after the inspection’s results—but that as of August, it had still not blocked access. The CI division does not participate in the BYOD program.

The IRS considered applying for an exception for the mobile devices, but had not done so by August.

A third violation involved another 23 mobile devices used by the IRS’s Communication and Liaison group to monitor social media websites. These devices also had access to TikTok, with the IRS simply stating that these devices were “unmanaged.” However, it did not request an exception for them—as required by the new law. After TIGTA’s findings, the IRS said it took action to block TikTok access on these 23 devices.

NTD contacted TIGTA for comment, but did not receive a reply before this article was published.

Timeframe

The Office of Management and Budget, which is the largest office in the executive office of the U.S. President, issued the implementation guidance for restricting TikTok in February 2023. It gave a 30-day deadline for deleting the application, and gave specific steps that needed to be followed. Limited exceptions were allowed for security research and law enforcement activities.

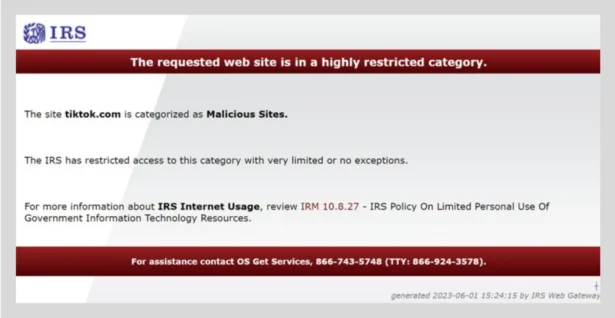

In devices where the IRS had blocked access to TikTok by means of a special software, the following message appeared when trying to access TikTok’s website, according to TIGTA’s report.

A similar message of a “restricted” page appeared on mobile devices.