The Internal Revenue Service (IRS) on Wednesday warned about scams targeting seniors in the lead-up to World Elder Abuse Awareness Day on June 15.

In an IRS press release, the agency warned about the threat of impersonation scams that pretend to be government officials with the aim of stealing sensitive personal information or money.

The scammers often pose as IRS representatives or representatives of other agencies, such as the Social Security Administration, Medicare, and the tax community, and use fear and deceit to exploit their usually elderly victims.

Sometimes, scammers say they are representatives of a known business or of a charity.

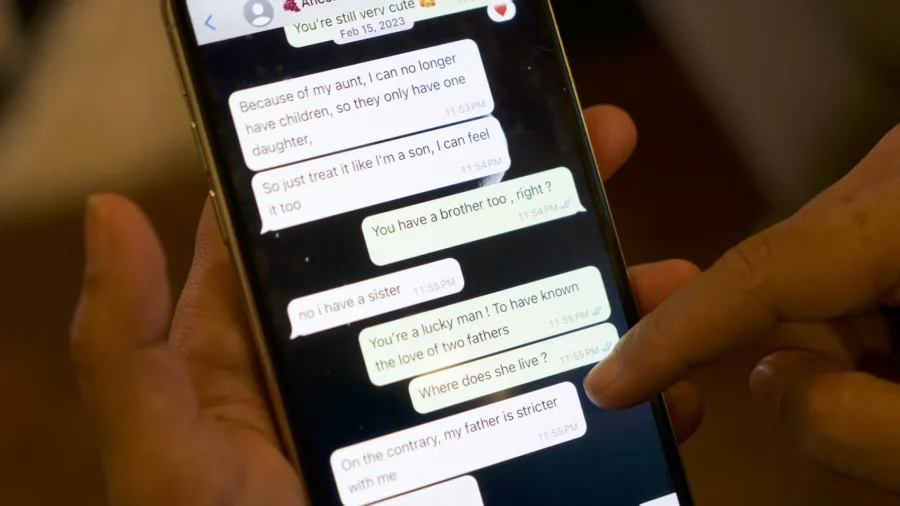

“Scammers often target seniors, attempting to steal personal information through phone calls, emails or text messages by pretending to be from the IRS or other agencies or businesses,” said IRS Commissioner Danny Werfel.

The IRS warning is part of efforts leading up to World Elder Abuse Awareness Day, which has been observed since 2006, with the aim of fostering “a better understanding of the neglect and abuse faced by millions of older adults,” the press release says.

Victims are pressured into making immediate payments through unconventional means, such as gift cards and wire transfers. The pretense is resolving non-existing tax liabilities or receiving fake tax refunds.

The scammers change their caller ID and appear to be calling from a real IRS telephone number.

Scammers can also ask that personal information is needed to verify accounts or to pay a fee for lottery winnings. They pressure for immediate action with threats of arrest, deportation, license suspension, or computer viruses.

In oder to hide the money transfer, scammers persuade the victims to use cryptocurrency, wire transfers, payment apps, or gift cards.

Given a rise in scamming attempts, the IRS has partnered with the Security Summit since 2015, a public-private program formed to protect taxpayers and the tax system against identity theft and refund fraud.

The Security Summit consists of “IRS, state tax agencies and the tax community, including tax preparation firms, software developers, payroll and tax financial product processors, tax professional organizations, and financial institutions. Total membership includes 42 state agencies and 24 industry offices in addition to the IRS,” according to IRS.

How IRS Operates

As defense measures, the IRS said that Americans should understand the way the IRS operates. For example, in case of a phone call, the agency would have already sent a mail about the account issue. If no mail has been received, the agency recommends hanging up immediately.

Scammers may also send malicious emails or texts. The IRS, however, does not initiate contact via email, text, or social media regarding tax bills or refunds.

In most cases, the IRS will send regular mail delivered by the United States Postal Service. Phone calls will be made in cases of an overdue tax bill, an unfiled tax return, or a missing employment tax deposit.

An IRS employee might also review assets or inspect a business as part of a collection investigation, audit, or ongoing criminal investigation.

The agency will never demand immediate payment via a prepaid card, a gift card, or a wire transfer. It will also never threaten to involve police nor demand payment without an opportunity to appeal. It will never request credit, debit, or gift card numbers over a phone call.

If suspicious of a scam, the IRS advises concerned people to contact the IRS customer service for verification at 800-829-1040 or for the hearing impaired, 800-829-4059.

To view details of an IRS account in order to verify what is told via a phone call, account holders can view their account on the IRS.gov website on the individual online account page.

People who received a fraudulent call or email can report it by visiting the hotline page of the Treasury Inspector General for Tax Administration or by calling 800-366-4484.