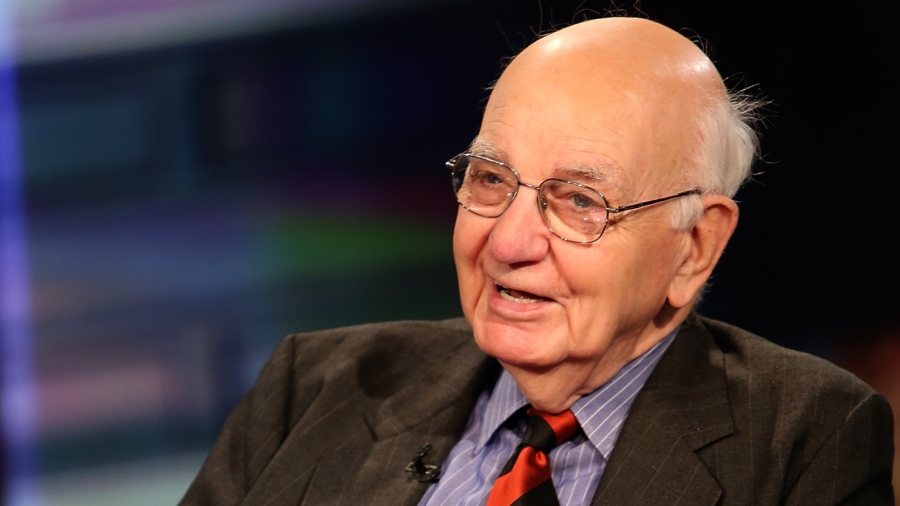

Former Federal Reserve chief Paul Volcker died at the age of 92, it was reported.

NPR reported that he had been suffering from prostate cancer before his death.

He was the chairman of the central bank under Presidents Jimmy Carter and Ronald Reagan.

“In terms of economic stability in the future, that [inflation] is what is likely to give us the most problems and create the biggest recession,” Volcker said in a 1979 Fed Open Markets Committee meeting before he became the Federal Reserve chairman, reported CNBC,

In 2018, he published a memoir “Keeping at It: The Quest for Sound Money and Good Government,” and he expressed concern about the direction of the federal government.

“The central issue is we’re developing into a plutocracy,” he told the New York Times in October 2018. “We’ve got an enormous number of enormously rich people that have convinced themselves that they’re rich because they’re smart and constructive. And they don’t like government and they don’t like to pay taxes.”

Volcker was known best for using high interest rates to reverse decades of inflation. The U.S. farming and manufacturing sector was hardest-hit by the interest rates.

In the midst of it, Volcker was vilified by the public. Homebuilders put postage stamps on bricks and on two-by-four wooden planks and mailed them to the Fed to protest how super-high interest rates had wrecked their businesses. Auto dealers, stuck with lots full of unsold cars, did the same with car keys. Angry farmers, struggling with high debts, drove their tractors to Washington and blockaded the Fed’s headquarters.

“Ultimately, the only way, I think that just say flatly interest rates will be brought down and stay down is to get the inflation rate down,” he told a Senate Banking Committee hearing in 1981, NPR noted.

Volcker later said in 1987 that if he could re-do it, “I would have played it different,” Fox Business reported.

Years later, he joined the Obama administration to help with its response to the 2007 and 2008 financial crisis and recession. Volcker had little sympathy for big banks in the wake of the financial crisis, which required a taxpayer bailout of big Wall Street firms. He dismissed claims that deregulated financial institutions deserved credit for coming up with innovative products and services.

He stood over 6-foot-7, spoke in a deep baritone, wore cheap suits, and smoked cigars, it has also been reported.

The only useful financial innovation he’d seen in years, he said, was the ATM.

The Associated Press contributed to this report.

From The Epoch Times