A senior Federal Reserve official said that the latest price data show inflation is still too high to warrant an easing of monetary policy and may even require further interest rate hikes

The remarks deliver a counterpoint to growing market expectations for a so-called Fed pivot.

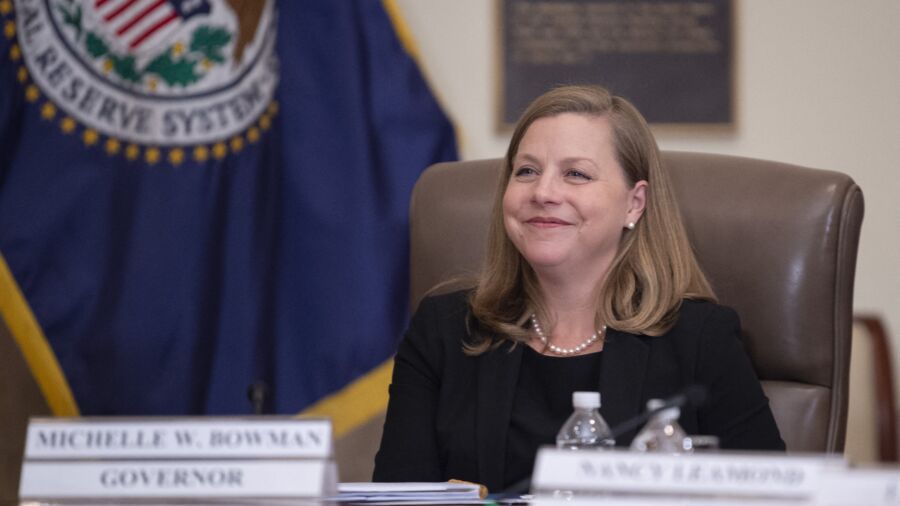

Michelle Bowman, who sits on the Fed’s Board of Governors and is a voting member of the central bank’s rate-setting Federal Open Market Committee (FOMC), made the remarks at a symposium on financial system construction in Germany.

Bowman said that the latest consumer price index (CPI) figures showed insufficient progress in the Fed’s fight to lower price pressures. They showed that inflation in April inched down in annual terms from 5.0 to 4.9 percent but shot up fourfold in monthly terms from 0.1 to 0.4 percent.

“In my view, the most recent CPI and employment reports have not provided consistent evidence that inflation is on a downward path,” Bowman said.

Faced with multi-decade high inflation, the Fed started hiking rates aggressively last March, bringing the benchmark federal funds rate up to a range of 5.0–5.25 percent at the latest FOMC meeting.

The Fed’s policy stance on interest rates “is now restrictive, but whether it is sufficiently restrictive to bring inflation down remains uncertain,” she added.

Markets have been betting heavily that there will be a pause in interest rate hikes over the summer months, with Bowman’s remarks offering a contrasting perspective.

“Should inflation remain high and the labor market remain tight, additional monetary policy tightening will likely be appropriate to attain a sufficiently restrictive stance of monetary policy to lower inflation over time,” she said.

“I also expect that our policy rate will need to remain sufficiently restrictive for some time to bring inflation down and create conditions that will support a sustainably strong labor market,” Bowman added.

Investors Predict Fed Pause

Investors expect the Fed to hit pause on further hikes when the FOMC meets on June 14. Futures contracts currently put the odds of a pause at just over 90 percent, according to the CME FedWatch Tool, up sharply from around 67 percent a month ago.

While there are currently no expectations for a rate drop at the June meeting, the odds of the Fed pulling rates back down to between 4.75–5.0 percent when the FOMC again meets in July now stand at a whopping 38.1 percent.

Remarks by Bowman, who said she would “look for signs of consistent evidence that inflation is on a downward path when considering future rate increases,” throw some cold water on expectations for a quick Fed pivot toward looser monetary settings.

Besides the month-over-month pace of inflation rising fourfold from 0.1 percent in March to 0.4 percent in April, underlying (or “core”) inflation remained strong. Core inflation, which strips out the volatile categories of food and energy, rose by 0.4 percent in April, the same elevated pace as the prior month.

A number of experts have expressed views that dovetail with Bowman’s, namely that the latest inflation data point to the Fed keeping interest rates high for longer—or even raising them further.

“Markets have been betting hard on there being a pause in interest rate rises over the summer months, but the Federal Reserve continues to hold that door open for more rises,” said Tom Hopkins, portfolio manager at BRI Wealth Management in London.

“Markets need to slowly wake up to the fact that the data is not cool enough, and the Fed is open to raise rates further,” he added.

Nearly 10 percent of investors think the Fed will deliver another quarter-point hike at the June 14 meeting, according to the CME tool.

“I don’t necessarily think it’s a blazing bullish report, but it’s going to give some people the option to argue for a pause and a pivot from the Fed, which I don’t think is the case,” said Kenny Polcari, chief market strategist at Slatestone Wealth in Florida.

“I think the Fed will raise rates again in June and then pause. I don’t see a pivot in all of 2023,” Polcari added, with a “pivot” being a reference to a broader shift toward easier monetary policy and a path to lower rates.

According to Bowman’s remarks on keeping a close eye on incoming data to inform rate-related decisions, Fed officials will have an additional CPI release before the FOMC’s next meeting on June 14.

A recent survey from Bankrate showed that the Fed’s fight to quash inflation had led Americans to report sharply higher levels of financial anxiety compared to before the central bank set out on its fastest pace of rate hikes since the 1980s.

“As the Fed has prioritized the battle against inflation through interest rate hikes since last March, high and sustained price gains have taken a toll on Americans both financially and on their mental health,” Mark Hamrick, senior economic analyst at Bankrate, told The Epoch Times in an emailed statement.

The Bankrate survey, published on May 8, showed that around 52 percent of Americans reported that concerns about money have had a negative impact on their mental health, up from 42 percent a year ago, with inflation being the most cited factor.

“The degree to which the war of inflation will be, or is being won, the better for individuals and households,” Hamrick said.

Warning Against Regulatory Clampdown

In her remarks, Bowman also warned policymakers against a heavy-handed reaction to the recent banking sector turmoil sparked by the collapse of Silicon Valley Bank (SVB).

She cautioned regulators against using the recent instability as a “pretext” for aggressive new banking rules, especially in light of the business models of the recently failed banks being “unique” in that they had an unusually high percentage of uninsured deposits, which made them vulnerable to depositor panics and bank runs.

“Our focus should be on remediating known, identified issues with bank supervision and issues that emerge from the public autopsy of these events,” she said.

Bowman argued that the U.S. banking system remains “strong and resilient despite recent banking stress,” adding that the sector today is more robust than during the 2008 financial crisis.

“Banks today are better capitalized, with more liquidity, and are subject to a new range of supervisory tools that did not exist prior to 2008,” she said.

A big risk of a regulatory over-reaction to the banking turmoil is encouraging bank consolidation, which she said would constrain the availability of credit to critical business activities and geographies as regional banks would be swallowed up by bigger rivals.

“The unique nature and business models of the banks that recently failed, in my view, do not justify imposing new, overly complex regulatory and supervisory expectations on a broad range of banks,” she said.

“If we allow this to occur, we will end up with a system of significantly fewer banks serving significantly fewer customers.”

“Those who will likely bear the burden of this new banking system are those at the lower end of the economic spectrum, both individuals and businesses.”

SVB relied on funding from extremely large deposits from the tech sector, which were mostly uninsured. Over 95 percent of the deposits at the California-based bank were uninsured, meaning above the $250,000 deposit insurance cap offered by the Federal Deposit Insurance Corporation.

The rapid unwind of SVB occurred when uninsured depositors began to pull out their money en masse after the bank reported a $1.8 billion loss on bond sales that had dropped in value owing to the Fed’s rate hikes.

A day before SVB’s collapse, its customers withdrew $42 billion in a single day, leaving it with a negative cash balance of about $1 billion.

The fallout from SVB’s collapse drove increased deposit outflows from smaller regional banks, with deposits at such institutions falling by a record amount during the week following SVB’s failure.

Reuters contributed to this report.

From The Epoch Times