The U.S. budget deficit is 16 percent higher than a year ago as the federal shortfall reached $532 billion in the first four months of the fiscal year, according to new Treasury data.

Last month, the federal shortfall was $22 billion, down 43 percent year over year when the monthly deficit was $39 billion. Outlays rose 3 percent, while tax receipts climbed 7 percent.

A decline in tax refunds drove the sharp drop as the Internal Revenue Service (IRS) eliminated a backlog of returns that were delayed by the coronavirus pandemic.

The chief spending contributors in January were led by Social Security ($121 billion), Medicare ($83 billion), health ($68 billion), and national defense ($60 billion).

Net interest payments were tied for the third-largest budgetary item in January. They exceed Medicare spending on a fiscal year-to-date basis, totaling $283 billion. Gross interest payments on Treasury debt securities are more than $357 billion, up 37 percent from the same time a year ago.

From October to January, the federal deficit stood at $531.86 billion, up 16 percent compared to the previous year.

However, the Congressional Budget Office (CBO) estimated in its Monthly Budget Review that the deficit would have been $80 billion higher, but “outlays in the first four months of each year were reduced by shifts of certain payments that otherwise would have been due on October 1, which fell on a weekend.”

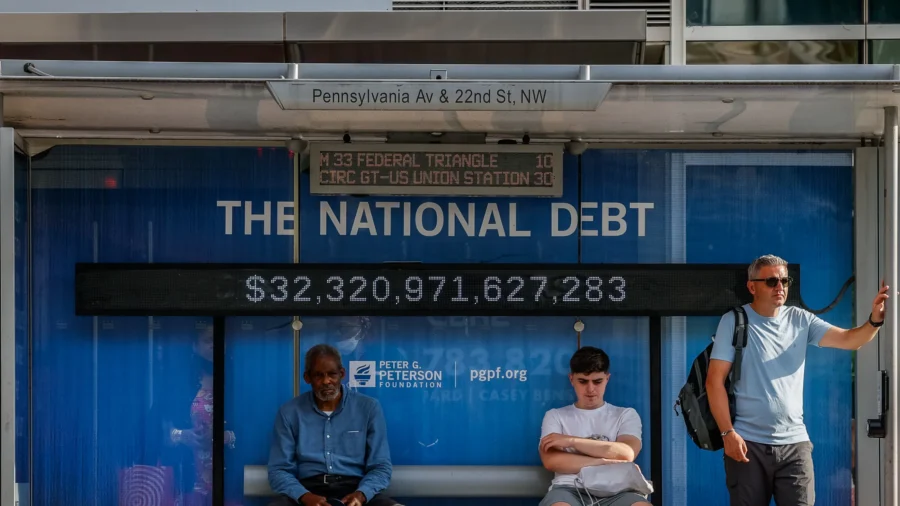

Since Jan. 2, 2024, the national debt has risen $228 billion, to $34.228 trillion. This is up 9 percent year-over-year.

The Treasury data confirm that “America is marching steadily along an unsustainable path,” says Maya MacGuineas, the president of the Committee for a Responsible Federal Budget.

“In the past four months, we’ve borrowed more than $4 billion per day; in the past 12 months, we’ve borrowed $1.8 trillion. How much longer can we pretend this is acceptable?” Ms. MacGuineas said in a statement.

CBO staff project a $1.5 trillion budget deficit for the current fiscal year.

Interest Payments

Interest—the cost to service the nation’s debt—is quickly turning into the fastest-growing part of the federal budget. Economists anticipate it will top $1 trillion this year and possibly leapfrog defense and Medicare.

“Interest costs will also slightly exceed net Medicare spending ($851 billion) this year and remain in line with Medicare costs in future years. That would make interest the second largest line item in the budget after Social Security,” the CRFB noted in a recent analysis.

“Although Medicare will overtake interest once again in 2028, the fact that both are growing so quickly should sound the alarm in regard to rising health care costs and growing debt.”

Interest payments, amounting to about $2.4 billion per day, are increasing so much that 44 percent of individual income taxes collected so far this year went to the interest.

By 2034, net interest payments are projected to surpass $1.6 trillion, representing 4 percent of the gross domestic product, according to the CBO’s recent 2024–2034 outlook. Cumulatively, interest payments will be roughly $12.4 trillion.

Likewise, the annual deficit is projected to rocket by 60 percent in 10 years. The national debt is expected to hit $48.3 trillion in the next decade, accounting for 116 percent of the GDP.

“The first message of the projections is a familiar one: that the fiscal trajectory is daunting,” said CBO Director Phillip L. Swagel in a press briefing with reporters on Feb. 7. “On the other hand, it is a little bit less bad than it was in our projections last year.”

Democrats have been focused on the rosier side of the CBO projections.

Appearing before lawmakers last week, Treasury Secretary Janet Yellen explained that interest payments were manageable and that a balanced budget was unnecessary to rein in these costs.

“We need to be on a fiscally sustainable path, and it’s critical to reduce deficits in order to ensure that that’s the case,” Ms. Yellen told the House Financial Servies Committee.

But no matter how they are examined, interest costs will soon reach a record high, says the Peter G. Peterson Foundation.

“Mounting interest costs put tremendous pressure on the federal budget, making it more difficult and costly to address pressing challenges and invest for the future,” the think tank focused on fiscal responsibility stated. “Rising interest costs also contribute to a vicious cycle of higher debt and additional interest costs.

Bill Hoagland, senior vice president at the Bipartisan Policy Center, urged policymakers on both sides of the aisle to address the nation’s pressing fiscal challenges.

“Members from both parties claim to agree that the nation’s fiscal path is unsustainable and in need of correction,” he said in a statement. “But actions speak louder than words, and difficult decisions about entitlement reform, revenue generation, and the budget process are required

From The Epoch Times