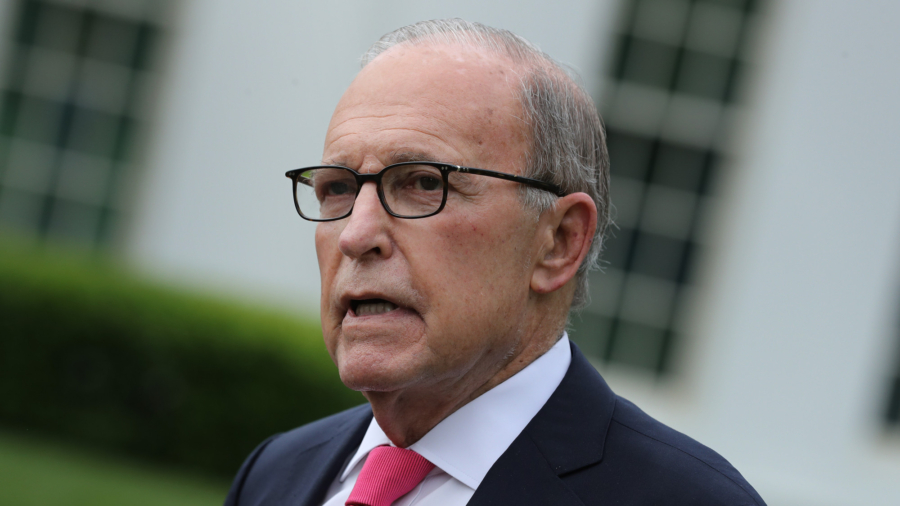

The White House would prefer to see a tax on capital gains cut to 15 percent, said adviser Larry Kudlow, who noted that President Donald Trump will not cut them by way of an executive order.

“We are looking at middle-class income tax cuts and capital gains tax cuts to spur investment and jobs and liquidity,” Kudlow told reporters at the White House on Tuesday. He added: “In another era, we used to call them tax cuts 2.0. The president has never lost those thoughts,” while adding that Joe Biden, the president’s 2020 rival, would raise taxes.

Kudlow said that it’s imperative that legislators in Congress work to come up with a cut to capital gains taxes, adding that it’s “not part” of any Trump executive order or plans on future executive action.

White House officials “had the economic committee during the campaign,” Kudlow remarked. “And we originally had a 15 percent capital gains tax rate. And I wouldn’t mind going back to that.”

“We’d like to take it back to 15 percent, where it was for quite a long time because it helps jobs, investment, productivity, and wages,” he reiterated. The capital-gains rate is currently 20 percent.

On Monday, Trump stated that he is considering a tax cut on the profit that results from the sale of a capital asset such as a stock, bond, or real estate. He didn’t specify how that could be carried out.

In a press conference, the president said he is also looking at “an income tax cut for middle-income families.”

“We are looking at expanding the cuts that we have already done, but specifically for middle-income families, and you will be hearing about that in the upcoming few weeks,” Trump said, adding that a capital-gains cut will produce more jobs.

While remaining mired in talks with top Democrats about a pandemic relief measure, Trump took executive action to provide a federal unemployment benefit of $300 per month, with states paying $100 per month. He also took action to suspend evictions for renters and homeowners, defer student loan payments, and suspend payroll taxes for people who make less than $104,000 per year.

Kudlow’s remarks on slashing the capital-gains tax mirror that of Treasury Secretary Steven Mnuchin, who told Fox News earlier that there is a need for “legislation to do what we want on that front.”

“That’s what we need now because of COVID. So I think for the next few years while we recover, we should reduce those capital gains,” he added.

As noted by Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, writing to investors, a cut to the rate “would require the support of Congress,” but Trump could issue an executive order “allowing the indexing of capital gains to inflation might be a realizable objective.”

The flurry of executive orders and talk about cutting taxes come as businesses struggle in the midst of the CCP (Chinese Communist Party) virus pandemic. More than 5 million cases of the virus have been confirmed in the United States, along with more than 160,000 deaths.

From The Epoch Times