Tesla CEO Elon Musk said there’s no silver bullet to fix the problem of high inflation, blaming central banks for printing too much money that’s chasing too few goods and pushing up prices.

Musk made the remarks in an April 18 interview with Tucker Carlson, who asked the billionaire tech mogul for his thoughts about the Federal Reserve’s interest rate policy and inflation.

“I’m going to tell you nothing you don’t know. But the concern is if the Fed drops rates again, then inflation will accelerate. And you can’t do that in an election year,” Carlson said.

“Inflation is going to happen no matter what,” Musk replied. “If you increase the money supply, you get inflation.”

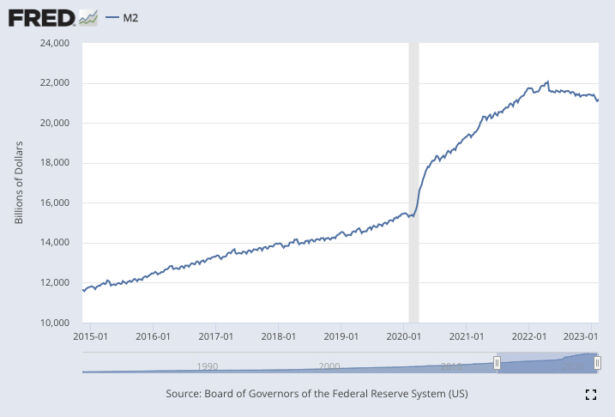

The Fed’s measure of M2 money supply—a benchmark for how much cash, bills, bank deposits, coins, and money market funds are circulating throughout the U.S. economy—exploded higher in March 2020, during the early stages of the pandemic recession.

The money supply kept climbing at an unprecedented pace from around $15 trillion in March 2020 to around $22 trillion in April 2022, when soaring inflation forced the Fed to start hiking interest rates. As of March 6, 2023, it’s down to just over $21 trillion.

The reversal in the growth of the money supply in April of 2022 came after over a decade of quantitative easing, wherein the Fed expanded its balance sheet by buying government securities at a feverish pace, driving down interest rates to near zero and flooding the economy with cheap money.

No Free Lunch

Like Musk, a number of economists and market watchers have blamed the recent bout of high inflation on the Fed’s money printing.

Kevin O’Leary, an investor who regularly appears on ABC’s Shark Tank program, said in an interview on the Daniela Cambone Show, that the Fed’s printing nearly $7 trillion in a relatively short amount of time would push prices higher.

“For all the talk of inflation, you print $6.72 trillion in thirty months, what … did you think was going to happen?” O’Leary said. “Of course, there’s going to be inflation.”

Musk said in the interview with Carlson that there’s no quick fix for inflation.

“There’s not some magical cure for getting rid of inflation except to increase the productivity, the output of goods and services,” Musk said.

“So what is money? You’ve got these sort of—it’s basically numbers in a database that come up some total. Then you’ve got the output of goods and services of the economy, and as long as the ratio of money to ratio of goods and services stays, if that stays constant, you have no inflation,” he continued.

“If you add more money to the system faster than you increase goods and services, then you have inflation,” Musk said, adding that there’s no such thing as a free lunch, or “some ability to issue money and not have inflation.”

Money Supply Shrinks

While the Fed pumped money into the system at a blistering pace prior to April 2022, the money supply has, over the past few months shrunk at a near-record pace, sparking recession fears.

“We have not seen money supply declines like this since the Great Depression,” said Mike Shedlock, an economist and registered investment advisor for SitkaPacific Capital Management. “The contrarian position isn’t that a recession will come later, but rather that it’s already started.”

In the week ending Feb. 6, 2023, the M2 money supply measure contracted by 1.84 percent from the same time a year ago.

“Due to the Fed’s monetary mismanagement, the M2 money supply is falling at its fastest rate since the 1930s,” said Steve Hanke, professor of applied economics at Johns Hopkins University. “The QUANTITY THEORY OF MONEY tells us that, [with] a 6-18 month lag after M2 drops, economic activity will slump.”

JPMorgan CEO Jamie Dimon said in a recent letter to shareholders that a key risk to the economic outlook is the impact of the Fed’s reversal of more than a decade of monetary easing and moving into a phase of quantitative tightening.

The shift away from the easy money policies of yesteryear is putting upward pressure on interest rates and making debt-servicing costs higher.

“While the central banks of the world are now selling instead of buying securities, the governments of the world have larger debts to finance. The United States alone needs to sell $2 trillion in securities, which must be absorbed in the market,” Dimon wrote.

He believes the United States and other economies are shifting from a savings glut to a scarcity of capital, along with higher interest rates and higher inflation than in the recent past.

“Essentially, we may be moving, as I read somewhere, from a virtuous cycle to a vicious cycle.”

Dimon also said that he doesn’t think the U.S. banking crisis is over.

“As I write this letter, the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come,” Dimon wrote in the letter.

The JPMorgan chief also predicted that credit supply would face a squeeze, though he added that it’s unclear whether that would lead to a consumer spending slowdown.

“It remains to be seen whether this will cause a little bit of a cliff effect or whether consumer spending will simply slow down. Either way, this will add to whatever recessionary pressures there are sometime in the future,” he predicted.

Consumer spending is a key driver of the U.S. economy, accounting for around two-thirds of output.

From The Epoch Times