Although the structure of the Consumer Financial Protection Bureau (CFPB), formed in the wake of the 2008 financial crash, is unconstitutional, the powerful agency may continue to exist under new rules, a divided Supreme Court ruled this morning.

The June 29 5-4 ruling in the case, known as Seila Law LLC v. CFPB, was a victory in part for the Trump administration, which asked the court to strike down the law, though the decision stopped short of nullifying the federal agency as the administration had wished. Oral arguments were heard March 3.

The CFPB was designed to be free of the influence of the president. Federal law blocks the president from dismissing its director, who has to be confirmed by the U.S. Senate, before that person’s five-year term lapses, unless the termination is for “inefficiency, neglect of duty, or malfeasance in office.”

The CFPB’s unusual funding mechanism also keeps the agency independent. Although it may seek funding from Congress, the agency is excluded from the normal congressional appropriations process, and instead receives most of the money it needs to operate from the Federal Reserve System.

The court noted the existence of the controversial funding system, but did not topple it, as some critics had hoped.

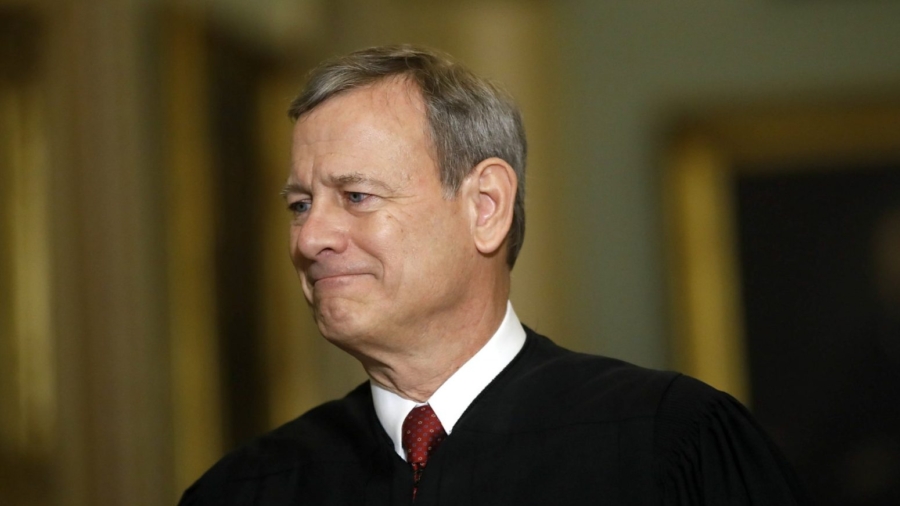

Chief Justice John Roberts wrote the majority opinion for the court, which was joined by four conservative justices. Justice Elena Kagan and three other liberal justices dissented from the court’s central holding.

The Supreme Court found that because the CFPB director, unlike the typical federal official, isn’t accountable to—that is, cannot be fired by—the president of the United States, the agency’s structure violates the separation of powers doctrine.

“The CFPB’s single-Director structure is an innovation with no foothold in history or tradition,” Roberts writes.

“In addition to being a historical anomaly, the CFPB’s single-Director configuration is incompatible with our constitutional structure. Aside from the sole exception of the Presidency, that structure scrupulously avoids concentrating power in the hands of any single individual.”

The Framers of the U.S. Constitution designed the office of president to make the holder “the most democratic and politically accountable official in Government. Only the President (along with the Vice President) is elected by the entire Nation,” Roberts writes.

The court found that the protection from removal enjoyed by the CFPB director, while unconstitutional, “is severable from the other statutory provisions bearing on the CFPB’s authority. The agency may therefore continue to operate, but its Director, in light of our decision, must be removable by the President at will.”

Democrats have long defended the 9-year-old agency, brainchild of U.S. Sen. Elizabeth Warren (D-Mass.), who was a bankruptcy law professor and consumer advocate before assuming office. Republicans accuse the agency of overreach.

Warren promptly celebrated the ruling on Twitter shortly after the court released it.

“Even after today’s ruling, the @CFPB is still an independent agency,” she wrote.

“The director of that agency still works for the American people. Not Donald Trump. Not Congress. Not the banking industry. Nothing in the Supreme Court ruling changes that.”

Then-President Barack Obama signed the Dodd–Frank Wall Street Reform and Consumer Protection Act, creating the CFPB, and appointed Warren to take the lead role in establishing it.

This is a developing story. This article will be updated later today as needed.

From The Epoch Times