For the first time in more than 20 years, the United States purchased more goods from Mexico than China in 2023, highlighting a change in international trade and spotlighting America’s de-risking efforts.

Last year, according to new Census Bureau data, the United States imported more than $475.6 billion worth of goods from its southern neighbor and exported about $323.2 billion.

The United States ran a $152.378 billion trade deficit with Mexico, up 16 percent from the previous year.

By comparison, the United States bought roughly $427 billion in goods from China and shipped nearly $148 billion worth of goods. America’s trade deficit with Beijing was close to $280 billion, narrowing 27 percent from 2022.

This made Mexico the chief source of official imports.

The last time U.S. trade with Mexico outpaced China was in 2002. That year, U.S.-Mexico trade totaled approximately $232 billion compared to U.S.-China trade of nearly $148 billion.

As part of the intensifying shift in global trade, Census data confirmed that December imports from South Korea were the highest on record, topping $116 billion. This marked the third consecutive year of rising imports. Plus, trade deficits with Germany, India, Italy, and Taiwan touched record levels.

Overall, America’s goods and services trade gap fell 19 percent year-over-year to $773.4 billion as exports edged up by $35 billion to $3.053 trillion and imports tumbled by $142.7 billion to slightly below $3.827 trillion.

This was the sharpest drop since 2009 amid companies’ efforts to limit inventory buildups and consumers’ spending patterns transitioning to services.

The goods deficit slipped by $121.3 billion to $1.061 trillion, and the services surplus rose by $56.4 billion to $288.2 billion.

The trade data further revealed that exports of foods and feeds and imports of consumer goods were the lowest since 2020.

Shipments of capital and consumer goods and motor vehicles were the highest on record.

The petroleum surplus rose to an all-time high of $30.1 billion as exports of natural gas and oil slumped in 2023.

In June 2018, then-President Donald Trump imposed 25 percent tariffs on $50 billion of Chinese goods. Beijing retaliated with its own set of tariffs, targeting more than 1,100 U.S. exports.

The Republican frontrunner revealed in a recent interview with Fox News “Sunday Morning Futures” that he is considering 60 percent tariffs on Chinese goods if he is elected, adding that he is not seeking to trigger another trade war.

“We have to do it,” President Trump said. “It’s not a trade war. I did great with China with everything. I want China to do great, I do. And I like … [leader Jinping] Xi a lot. He was a very good friend of mine during my term.”

For the most part, President Joe Biden has kept the Trump-era tariffs intact. However, reports suggest that the White House has been considering doubling down on this trade policy by raising levies on various Chinese goods, like electric vehicles, as part of the administration’s efforts to enhance the domestic clean-energy sector.

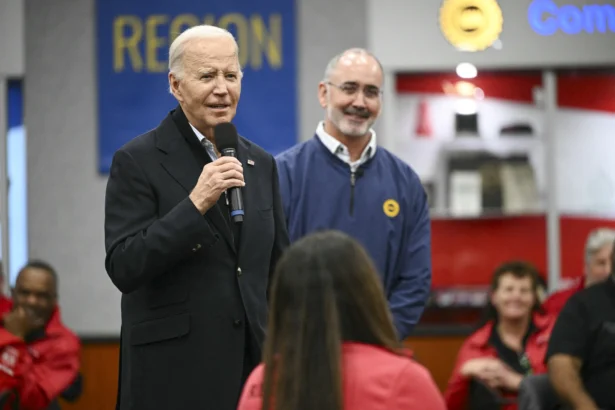

Before a crowd of United Auto Workers (UAW) members, President Biden promised that he would “not let” China dominate the global electric vehicle market “by using unfair trade practices.”

Over the past year, President Biden has embarked upon a campaign of diversifying the global supply chain by no longer depending solely on China. U.S. officials have described this as de-risking rather than decoupling, expanding trade relations with a whole host of countries, particularly in the Indo-Pacific.

“The United States does not seek to decouple from China,” Treasury Secretary Janet Yellen said in a November 2023 speech at an Asian Society event.

A breakup between the world’s two largest economies would result in “significant negative global repercussions” and be “simply not practical,” she explained.

“Instead, we are de-risking and diversifying, by investing at home and strengthening linkages with allies and partners around the world,” Ms. Yellen stated.

China’s economy has been turbulent over the past year, fueled by a collapse in the property sector and mounting debt challenges. The stock market has responded to the chaos by falling sharply, prompting the government to float a rescue package.

Federal Reserve Chair Jerome Powell acknowledged what is unfolding in Beijing, noting that it is unlikely the U.S. would suffer from the instability.

“As long as what happens in China doesn’t lead to significant disruptions in the economy or the financial system, then the implications for the United States—we may feel them a bit, but they shouldn’t be that large,” Mr. Powell told CBS News “60 Minutes.”

Reshoring Incentives

President Biden has fostered the reshoring of U.S. manufacturing and foreign inbounding as part of the administration’s landmark legislation—the Inflation Reduction Act and the CHIPS and Science Act.

By extending hundreds of billions of dollars in federal and state subsidies, be it grants or tax credits, the White House has been hoping to ensure more domestic and foreign corporations establish or expand their presence stateside.

The challenge for the industry has been that U.S. manufacturing is paralyzed in contraction or stagnation, depending on the metrics.

The Institute for Supply Management’s (ISM) Purchasing Managers’ Index (PMI), a gauge of whether the manufacturing sector is growing or shrinking, was stuck in contraction territory for the 15th consecutive month in January.

The S&P Global U.S. Manufacturing reported expanding factory activity last month and recorded the best reading since September 2022. This marked only the third time a positive PMI reading since December 2022.

A chorus of economists purports that current industrial policy is not leading to a U.S. manufacturing revival.

Instead, these legislative pursuits have been another mechanism of “saying the federal government picks winners and losers,” says Jason Sorens, an economist with the American Institute for Economic Research (AIER).

“Not a single subsidized chip fab [factory] has opened its doors yet, and manufacturing production is down slightly,” Ms. Sorens wrote in a Fox News op-ed.

From The Epoch Times