Republicans on the House Oversight Committee’s Subcommittee launched a new probe into the Federal Deposit Insurance Corporation (FDIC) on Monday to investigate the allegations of sexual harassment within the agency.

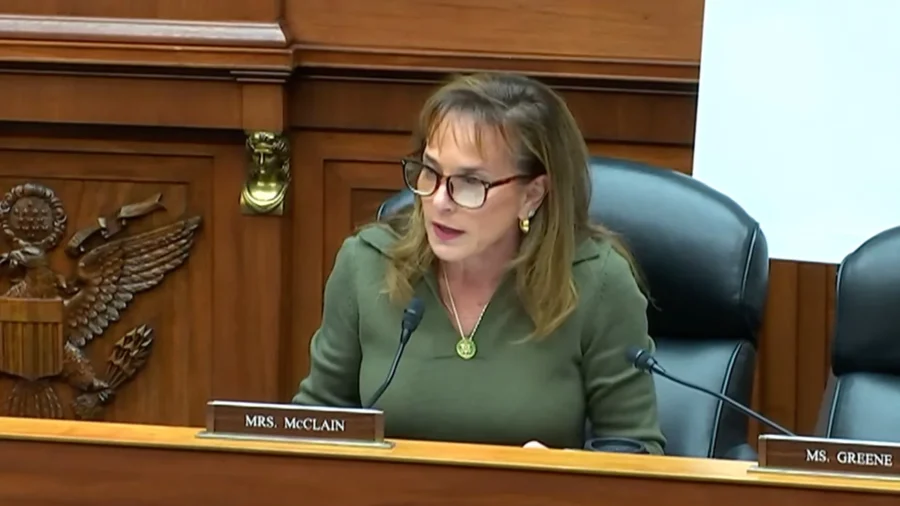

Subcommittee on Health Care and Financial Services Chairwoman Lisa McClain (R-Mich.) and Rep. Andy Biggs (R-Ariz.) sent a letter to FDIC Chairman Martin Gruenberg on Monday, calling on him to turn over records of sexual harassment complaints within the agency and the official record of the responses those complaints received.

The Republican lawmakers further called for internal communications about these complaints shared by the FDIC’s human resources department and by employees in the chairman’s office.

The investigation comes after The Wall Street Journal published a series of articles last week alleging a culture of excessive drinking and partying, as well as harassment and discrimination with little recourse for complaints.

Following the initial reporting by the Journal, Mr. Gruenberg reportedly told employees last week that he had ordered an outside law firm, BakerHostetler, to conduct an independent review of these allegations.

“The reports by The Wall Street Journal describe an abusive culture of sexual harassment and discrimination within the FDIC, and a lack of internal processes encouraging reporting and effective responses to such allegations,” Msr. McClain and Mr. Biggs wrote in their letter addressing Mr. Gruenberg.

NTD News reached out to the FDIC and Mr. Grunberg for additional comment. An FDIC spokesperson responded that the agency “is committed to being fully transparent” for congressional investigators.

Republicans Place Allegations Alongside 2023 Bank Failures

These allegations against the FDIC come after a series of high-profile bank failures this year. The collapses this year of First Republic Bank, Silicon Valley Bank, and Signature Bank, respectively represent the second-, third-, and fourth-largest banking failures in U.S. history.

“FDIC was established to restore and maintain confidence in times of crisis. On the heels of several bank failures which shook confidence in the banking system and led the Biden Administration to take unprecedented steps to contain further panic, the allegations of a culture of tolerating harassment at the FDIC weakens the credibility of your agency,” the Republicans wrote on Monday.

With Ms. McClain and Mr. Bigg’s letter on Monday, the House Oversight Committee is now the second committee in the House of Representatives that’s demanding answers from Mr. Gruenberg and the FDIC.

On Friday, House Financial Services Committee Chairman Patrick McHenry (R-N.C.) launched his committee’s own investigation into the sexual harassment allegations against the FDIC. In a letter, Mr. McHenry warned the FDIC chairman that he would use the committee’s “full arsenal of oversight and investigative tools” to scrutinize the agency.

Mr. McHenry said his committee is also concerned that the allegations about the FDIC’s workplace culture hindered its capacity to foresee and respond to recent bank failures. The Republican lawmakers noted an April FDIC report on the failure of Signature Bank states that the FDIC “experienced resource challenges with examinations staff that affected the timeliness and quality of SBNY examinations.”

The Republican lawmaker said that disclosure in the FDIC report provided few details about the staffing challenges the agency faced.

“Your report’s limited discussion of staffing challenges related to bank examiners did not consider how the longstanding toxic FDIC culture inhibits employee retention,” Mr. McHenry wrote.

“By ignoring or choosing to remain silent about workplace misconduct at the FDIC, your leadership may have contributed to the financial instability and threats to financial security of Americans that were observed in March.”

Mr. Gruenberg gave testimony before the House Financial Services Committee on Nov. 15, during which he initially testified that he’d never been investigated for inappropriate behavior. The FDIC chairman later clarified that he had been interviewed in 2008 in response to “a concern raised by an employee” but said he wasn’t aware of what came of that review and didn’t elaborate further.

FDIC Faces Bipartisan Pressure

FDIC has seen pressure from lawmakers on both sides of the aisle to address the allegations impacting the bank insurer.

In addition to the outside investigation Mr. Gruenberg reportedly ordered from BakerHostetler, Sen. Sherrod Brown (D-Ohio) has called on the FDIC’s Office of the Inspector General to undergo its own “independent and thorough” review of the allegations.

“These are serious allegations that must be investigated and those responsible should be held accountable,” added Rep. Bill Foster (D-Ill.), who sits on the House Financial Services Committee.

In a Nov. 15 press statement, FDIC Director Jonathan McKernan said the agency would release harassment victims from confidentiality agreements they may have reached with the agency. Mr. McKernan said the agency will also provide answers for why no FDIC officials were fired amid these harassment allegations.

Some Republican lawmakers are already pushing beyond calls for investigation, demanding Mr. Gruenberg’s resignation.

In a Nov. 16 social media post, Sen. Thom Tillis (R-N.C.) concluded that changes at the FDIC are “desperately needed” and aren’t possible with Mr. Gruenberg still in charge.

In another letter to Mr. Gruenberg on Nov. 16, Sen. John Kennedy (R-La.) said the 2008 investigation Mr. Gruenberg disclosed the day prior stemmed from an incident in which another FDIC official left a voicemail cursing at an employee. Mr. Kennedy said the FDIC paid out a $100,000 settlement to the employee, but that Mr. Gruenberg later promoted the very same official about whom the complaint was filed.

“Far from addressing unacceptable conduct, this promotion implies that you reward it,” the Louisiana Republican wrote to Mr. Gruenberg.

Mr. Kennedy further noted recent testimony in which Mr. Gruenberg admitted he hadn’t personally acted to address numerous other complaints throughout his chair and as acting chair of the FDIC.

“As a result of these troubling reports and your apparent unwillingness to address them, I call for your resignation so that a new chair can restore the professional culture at the FDIC that the American people expect from its institutions,” Mr. Kennedy wrote.